Dodd-Frank amended for Seller Financing!!

Here’s a quick update for those of you who do owner-financing to your end buyers as part of your business model…

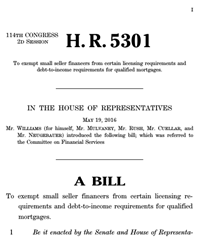

Let me introduce you to HR 5301 – The Seller Finance Enhancement Act..

This bill makes minor changes to the Dodd-Frank rules and regs governing seller-financed deals. Currently, if you’re financing deals for your end-buyer, you can do only three (3) deals in a 12 month period before having to become (or employ) a registered mortgage loan originator. HR 5301 will change that…IF it passes 🙂

Here’s the scoop…

•HR 5301 will amend the Dodd-Frank Act to allow up to two (2) seller-financed transactions per month (or 24 per year) without the need for the seller to be licensed as a mortgage loan originator. [Now, I personally think this should be unlimited – but the National Association of Realtors would only agree to remain neutral regarding the bill if a cap was included on the number of transactions per year – go figure!!]

•HR 5301 will not remove any of the safeguards related to these transactions. Seller financiers must still comply with “ability-to-pay” portions of Dodd-Frank, as well as interest rate rules and the ban on balloon payments.

This is great news and certainly a move in the right direction for us investors. So be sure to connect with your representative and let him know of your support for this bill!

What do you think of this change? Just comment below and let me know. I’d love to hear your thoughts.

By the way, if the current version of Dodd-Frank has you confused about the status of seller-finance deals check out my cheat sheet Seller Financing and the Dodd-Frank Act. Download your free copy here.

You already know my thoughts. The Dodd-Frank Act is unconstitutional and should be repealed. How the National Association of Realtors hasn’t been sued for Antitrust and disbanded is a true testament to the corruption in Washington and the power of money and lobbyists.

I do not disagree 🙂

Great news on this! Seller financing is a good thing for the economy and the benefits far outway any downsides. The more the merrier.

Great post, Bill! Do you know if the limit is 24 per year or 2 per month? Sounds the same, but may be different if deals aren’t spread evenly throughout the year.

Good point Bryan – The proposed bill reads, in relevant part:

I interpret this to mean 24 transactions in a 12 month period.

That’s definitely good news!

What exactly do you have to do to meet the ability to repay requirement?

Chuck, the Dodd Frank Act requires that a lender consider the borrowers ability to repay (ATR) the loan. This usually includes verifying and documenting income and assets, employment status, simultaneous loans, sources of income, and credit history. The borrower’s DTI should be calculated as part of the process.

The Economic Growth, Regulatory Relief, and Consumer Protection Act (S 2155) was signed just this week and is rolling back some of the Dodd Frank requirements. However, we’re not certain yet how those rollbacks will affect seller financed deals. I’ll be doing some research on the this weekend 🙂

So, Bill, what did your research uncover?

Where are we right now on DF?

Thank you.

Hey Bob! With this bit of legislation we are pretty much no where. It was introduced into the House where it died. There are a few folks who are still actively trying to get the seller-finance provisions changed but those activities slowed when there was a chance that DF might be amended. And, to some extent, it was. Unfortunately none of the changes helped us investors at all.